Introduction

Italy is often perceived as a challenging market: complex bureaucracy, fragmented business culture, and regional differences. Yet, recent data show a clear trend — the country is increasingly attractive to foreign investors, not only to large multinationals but also to small and medium-sized enterprises (SMEs).

While export-oriented studies on Made in Italy abound, much less attention is given to foreign SMEs establishing operations in Italy or trading with Italian partners. This article fills that gap, offering a snapshot of the latest data and practical insights for SMEs considering Italy as their next growth destination.

Italy as a hub for foreign direct investment (FDI)

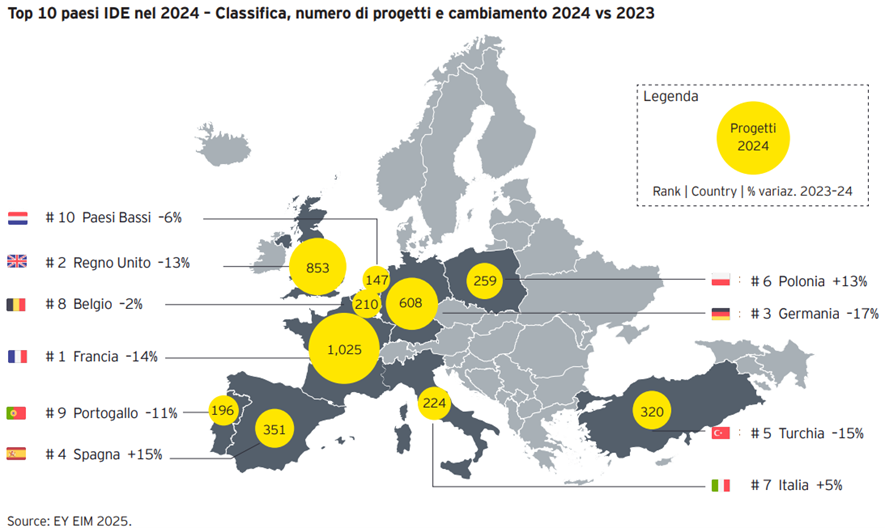

According to the EY Attractiveness Survey Italy 2025, Italy recorded a +5% increase in FDI projects in 2024, from 214 to 224, against a European average decline of –5%. This moved Italy up to 7th place in Europe, with a 4.2% share of projects.

-

Main investor countries: Germany (14%), France (13%), UK (11%), Switzerland (9%).

-

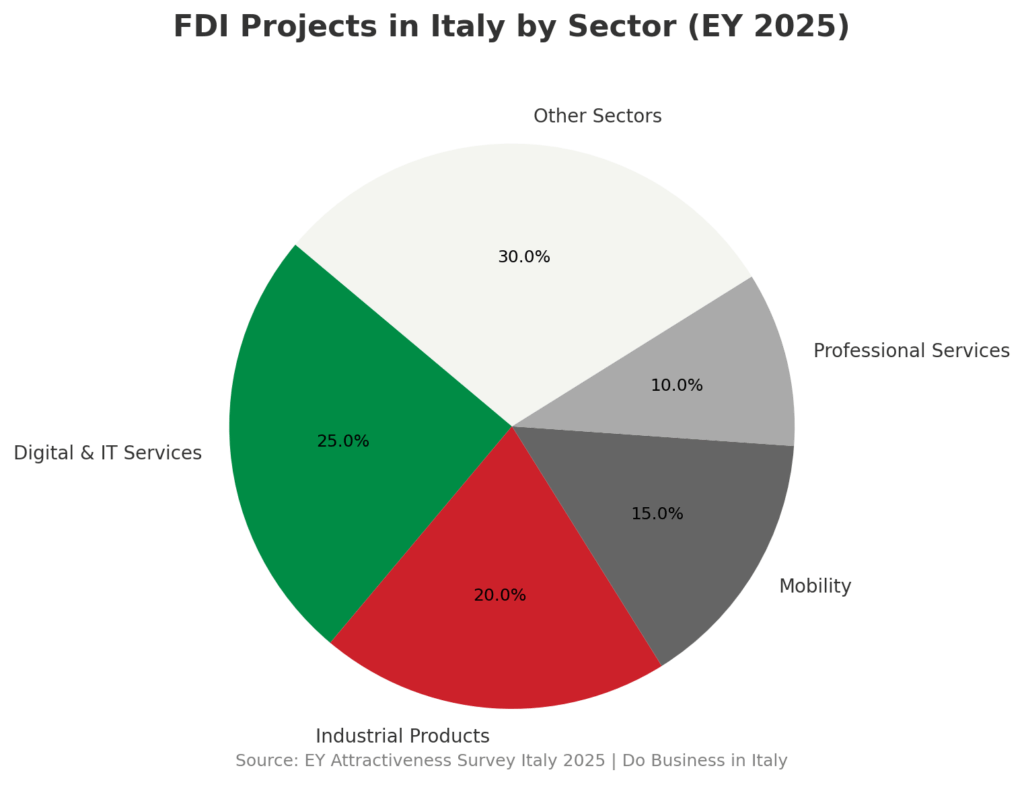

Top sectors: digital & IT (25%), professional services, manufacturing, and mobility.

This momentum signals that Italy is gaining ground as a competitive and reliable market for international investors.

Foreign SMEs in Italy: contribution and role

Foreign-owned companies in Italy are not just large corporations. Many SMEs have established a strong presence, bringing both innovation and international know-how.

-

They account for 33.8% of Italian exports, worth about €190 billion in 2024.

-

71.2% introduced innovations between 2020–2022, compared to less than 60% of domestic firms.

-

Regional concentration: over 82% of the added value is generated in Lombardy, Lazio, Piedmont, Veneto, Emilia-Romagna, and Tuscany.

-

Origin countries: Germany (2,860 firms), USA (2,603), France (2,435), UK (2,111), Switzerland (1,462).

Foreign SMEs are therefore key drivers of Italy’s competitiveness, particularly in high-value-added and export-oriented sectors.

Italian SMEs as exporters: a mirror perspective

On the other side, Italian SMEs themselves are among the most export-oriented in Europe:

-

They generate up to 53% of Italy’s total exports (vs. 25% in France and Germany; EU average 40%).

-

In 2021, Italian SMEs exported €219 billion, equal to 46% of national exports.

-

Nearly 70% of manufacturing SMEs are active in export, and manufacturing alone drives 80% of SME export value.

-

Medium-sized enterprises show the highest growth, with export forecasts of +6.2% in 2023 and +7.3% in 2024.

This dual role — SMEs as both inbound investors and outbound exporters — makes them central to Italy’s economic fabric.

Opportunities for foreign SMEs

For foreign SMEs considering Italy, three opportunity areas stand out:

-

Digital & IT services: Italy is Europe’s fourth-largest digital market and growing.

-

Advanced manufacturing & industrial products: strong supply chain integration and demand for innovation.

-

Professional & technical services: demand for specialized skills and international expertise.

Additionally, regional and national incentives (e.g., Invitalia contracts, special economic zones, R&D tax credits) can ease entry barriers.

Conclusion: why SMEs should look at Italy

Italy’s FDI momentum, the innovative role of foreign SMEs, and the strong export vocation of Italian SMEs combine to create a fertile ground for business development.

For small and medium-sized enterprises abroad, this means there is room to grow, partner, and invest in a market that is regaining international trust — Italy recently entered the Top 10 of Kearney’s Global FDI Confidence Index, ranking 8th worldwide.

👉 At Do Business in Italy, we help foreign SMEs navigate this landscape: from market entry strategy to local business development and representation in Italy.

Your growth in Italy can start today.